Portfolio characteristics

42 Dutch retail properties (€ 719.1 million; 205,513 m²)

Focus on Experience and Convenience

Focus on Randstad urban conurbation

Continuously high occupancy rate

Continuous outperformance of IPD Property Index

High percentage of green energy labels (A, B or C label)

GRESB Green Star status for two years in a row

Focus on Experience and Convenience

High streets: focus on A1 locations in best shopping cities

As consumers now have a much wider choice in terms of how they buy fashion and lifestyle products (online and offline), the differentiating potential of shopping cities and locations is now more important than ever. With this in mind, Bouwinvest and the experts at its research department have determined the Top 10 shopping cities on the basis of criteria such as consumer numbers, rent per m² and the number of inhabitants in the specific catchment area.

For acquisition purposes, the Fund also uses the ‘Top shopping streets ranking’ drawn up by Bouwinvest’s research department. This provides an overview of the most attractive shopping streets in the Netherlands, based on indicators including growth in the number of residents, average incomes, number of annual tourists and the numbers of passers-by. The Fund focuses very strongly on Amsterdam, due to its status as an international shopping city, plus the strong growth forecast for the Dutch capital.

District shopping centres: focus on catchment area

A healthy catchment area is the main factor in the success of any district shopping centre with a focus on daily shopping needs. The health – and size – of a catchment area can be affected by the regional economy, the local and regional demographic outlook and competing retail stock. A healthy regional economy guarantees employment and income growth, while demographic growth has a visible impact on a shopping centre’s potential market. On the other hand, new retail stock can lead to a reduction in a centre’s effective catchment area.

In addition, the Fund focuses on a number of additional factors that increase the level of convenience so prized by today’s consumers, an element that the Fund believes will become ever more important in the future. These additional criteria include easy accessibility, comfort parking, an effective tenant mix, plus the overall look and routing of the centre. One essential part of the retail mix is one or two clear supermarket anchors, as these act as a major ‘pull’ factor for convenience shoppers.

Major segments

Following the disposal of non-core asset in 2015, virtually all of the portfolio’s assets are now high-quality retail facilities. In line with our strategic focus, the properties can be divided into two segments:

EXPERIENCE - High street retail

The main focus of Fund’s high street retail portfolio is individual high street shops or clusters of shops in retail units located in prime shopping areas in major Dutch city centres. These city centres have retained their market share and will continue to do so in the future. The historic surroundings, the varied supply of retail formulas, plus restaurants and other leisure facilities, help keep these shopping areas attractive and popular, as they offer today’s consumers the experience and ‘fun factor’ they demand. Very importantly, these shopping areas are widely seen as the most future-proof segment of the retail market, which will continue to drive demand for retail space from a wide range of fashion and lifestyle retail brands, both national and international.

CONVENIENCE - District shopping centres

The Fund’s district shopping centres thrive thanks to their excellent catchment areas, which are either stable or growing. These easily accessible retail destinations, offering a wide range of products and goods, cater to consumers looking for convenient daily shopping close to home. Plentiful parking spaces also help to increase the centres’ effective catchment area.

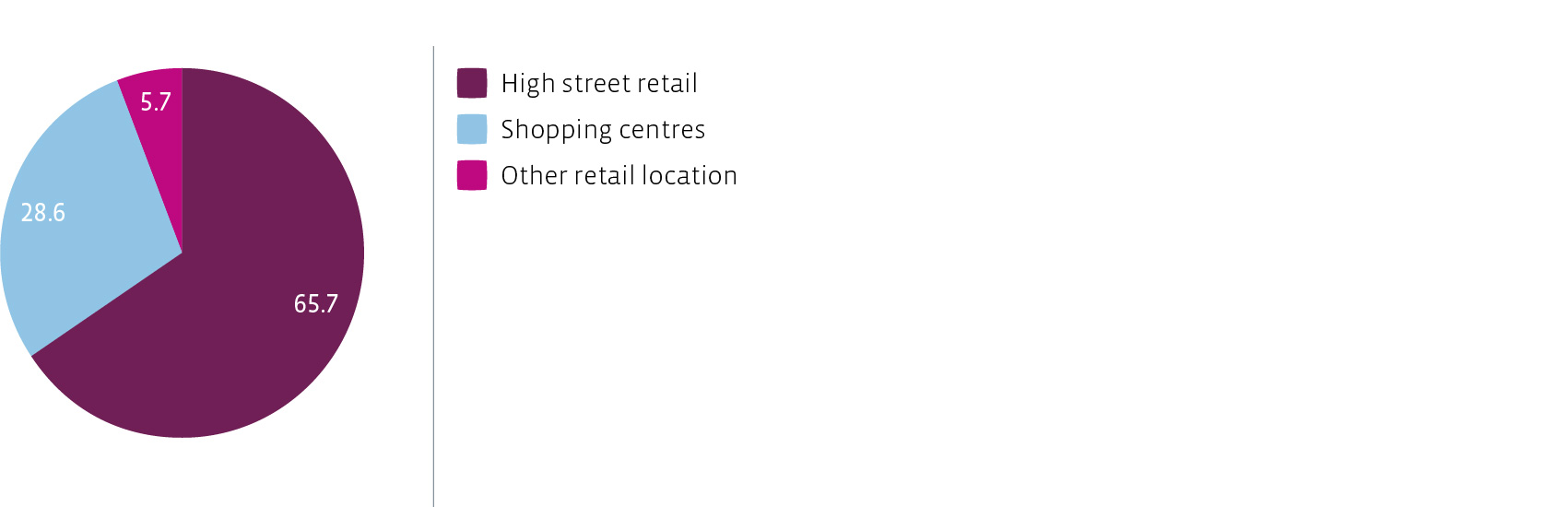

Portfolio composition by type of retail location based on book value