Portfolio composition at year-end 2015:

Diversification guidelines and investment restrictions

The new diversification guidelines are applicable as per 1 January 2016. Therefore the current portfolio as per 31 December 2015 is compared with the current diversification guidelines and investment restrictions.

Diversification guidelines | Current portfolio | Conclusion |

≥ 80% of investments invested in core regions | 91.1% in core regions | Compliant |

Investment restrictions | | |

< 5% invested in single investment property | There is no single investment property exceeding 5% of the total portfolio of € 3.0 billion | Compliant |

< 10% invested in non-core (non-residential) properties | Investments in non-core properties are 0.9% | Compliant |

< 10% pre-finance acquisitions | Investments under construction are < 7% | Compliant |

No investments that will have a material adverse effect on the Fund’s diversification guidelines | There have been no investments in 2015 that have a material adverse effect on the Fund's diversification guidelines | Compliant |

Time to market: investments and divestments in 2015

The Fund is backed by its anchor investor, bpfBOUW and by a number of third-party investors. This enabled the Fund to acquire some very high-quality housing products in Bouwinvest's core regions. Most acquisitions were in inner-city locations in the Randstad urban conurbation.

Acquisition of 15 projects for a total of € 466 million

As a result of our active focus on the acquisition of new properties, we reached agreements on a total of:

A selection of the 15 acquisitions are described below.

Haarlemmerweg, Amsterdam – 450 apartments

The Haarlemmerweg development is an enormous residential development at a former office location in the Dutch capital. It is located nearby Westerpark and the A10 ring road close to Sloterdijk railway station. The project will eventually encompass 900 apartments, covering a wide range of rental and owner-occupied homes, which will create a lively mix of residents in an upcoming area in Amsterdam. The rental apartments will all be in the liberalised sector and every unique building has its own sustainability ambitions. We expect this project to attract a range of target groups (single-person households, starters, elderly people and families) and we have acquired full ownership of the land.

Nautique Living, Amsterdam – 475 apartments

The project is located in the NDSM area of the capital city, which is characterised by its industrial look. This development includes 475 apartments in the liberalised rental sector, some commercial units and 142 parking places. The total development consists of seven buildings and the Residential Fund has acquired five of these. At the moment there are not many public facilities in the neighbourhood but Amsterdam Central Station is a 15-minutes ride away. The size of the apartments varies from 45 m² to 108 m² and all apartments have their own storage space. The parking garage also includes a general bike storage space.

Kop Weespertrekvaart, Amsterdam – 262 apartments

This development project is located in the lively Overamstel area and is close to roads, public transport, green areas and water. It is one of the areas in Amsterdam that has been designated for the construction of large numbers of new homes. The Residential Fund has acquired 262 apartments, with 102 of these in the government regulated sector. The size of the liberalised sector apartments varies from 50 m² till 90 m², while the regulated apartments are about 51 m². There is also a shared bike storage area and underground parking for 144 cars, plus one commercial unit of 114 m². The upper floors (41 apartments) and 41 parking places are owner-occupied.

Rijswijk Buiten, Rijswijk – 43 family homes

Rijswijk Buiten is part of the Sion expansion in Rijswijk. The total expansion consists of 1,200 houses with very high sustainability targets. The 43 family homes are equipped with solar panels, triple glazing, quality flow ventilation system and more. The aim of these measures is to build homes with an energy performance coefficient (EPC or EP score) of zero and to provide them with combined heating and cooling. Using this EPC system guarantees that the homebound energy is reduced to zero and that the homes qualify for energy label A ++++ .

Rijswijk is located in the Randstad region, within commutable distance from The Hague, Delft and Rotterdam, and offers easy access by car and public transport, plus a wide range of amenities within walking distance.

Blok 61, Eindhoven – 96 apartments

Former Philips’s industrial site Strijp-S has been in redevelopment since 2006 and it is still gaining in popularity. The area is being transformed into a dynamic hub, where you can live, work and relax. Strijp-S is home to numerous creative companies and hosts the annual Dutch Design week. The Residential Fund acquired Blok 61, which consists of 96 apartments, two commercial units and 58 private parking spaces. Future residents can choose between five types of loft type apartments, ranging from 58 m² to 85 m², and have a choice of various floor plans.

Zijdebalen, Utrecht – 177 apartments

The Zijdebalen urban redevelopment project in Utrecht’s lively city centre consists of four urban blocks offering a total of around 500 rental and owner-occupied homes. The development covers a diverse mix of housing types, including apartments, luxury penthouses and spacious city houses fronting onto the local river, the Vecht. The 177 apartments the Fund has agreed to acquire include 65 m² starter homes, spacious city apartments ranging from 80 m² to 100 m² and several luxury 130 m² apartments, all built over semi-subterranean parking garages. And to make sure Zijdebalen becomes a truly multifunctional urban living area, the development has earmarked space for a number of small-scale commercial functions, including a restaurant, café, offices and/or flexible workspaces with meeting rooms.

Nieuw Nachtegaalplein, Nijmegen – 67 family homes

The 67 family homes in the Nieuw Nachtegaalplein project in Nijmegen are situated in the Wolfskuil neighbourhood. This centrally located area, within walking distance of the train station, the historic city centre and the famous Kronenburgerpark, is part of an urban redevelopment. This is the transformation of a former working class neighbourhood into a diversified neighbourhood that is also attractive for young urban households. Nijmegen is a university town with expected above-average growth in households. The project will be delivered in two phases. The first 29 houses will be delivered in 2016 and the remaining 38 houses will be completed in 2017.

Up:Town, Rotterdam – 151 apartments

The striking 107-metre high Up:Town building is set to rise in the popular Wijnhaven quarter of Rotterdam. This building includes around 200 apartments and five ‘urban villas’ on the ground floor. Bouwinvest has acquired 151 apartments on the floors 0 to 16, with surface areas varying from 55 m² to 83 m². The range of floor areas distinguishes these apartments from those offered by competitors, who provide larger surfaces for higher prices. The upper 10 floors will be developed as owner-occupied apartments with flexible floorplans. In the original plan, office space was planned for the ground floor, but at the request of Bouwinvest this office space has been transformed into five distinctive urban villas with a surface area of around 130 m². We think houses are particularly suited to meet the increasing demand for living (and working) in the city.

Wijnhaveneiland is located in a strategic spot in the city. After the Second World War, this area was built as a business district. But from the 1980s onwards this area has been gradually transformed into a attractivel residential neighbourhood. Although almost 1,000 homes have already been added to this area over the past 10 years, there is still a strong demand for residential space here. Up:Town will be built on one of the few remaining spots in the area.

Asset | City | No. of residential units | Expected rental level |

Jeruzalem | AMSTERDAM | 24 | € 1,236 - € 1,328 |

Haarlemmerweg | AMSTERDAM | 275 - 450 | € 916 - € 1,240 |

Nautique Living | AMSTERDAM | 475 | € 830 - € 1,340 |

Kop Weespertrekvaart | AMSTERDAM | 262 | € 710 - € 1,505 |

Picus Kadegebouw | EINDHOVEN | 36 | € 930 - € 1,135 |

Villa Industria (Entree en B3) | HILVERSUM | 26 | € 878 - € 1,394 |

Onder Onnes | NIJMEGEN | 46 | € 867 - € 997 |

Rijswijk Buiten | RIJSWIJK | 43 | € 829 - € 990 |

Zijdebalen I tm IV | UTRECHT | 300 | € 896 - € 1,469 |

Vredenburgplein | UTRECHT | 60 | €1,000 - € 1,545 |

Verbuntterrein | TILBURG | 76 | € 785 |

T&D location | DEVENTER | 41 | €740 - € 847 |

Loolaan | APELDOORN | 39 | € 910 - € 1,256 |

Blok 61 | EINDHOVEN | 96 | € 742 - € 889 |

Nachtegaalplein | NIJMEGEN | 67 | € 869 - € 997 |

UP:TOWN | ROTTERDAM | 151 | € 777 - € 976 |

Fund lowers disposal target

After beating the sales target in 2014 and in view of the Fund’s growth strategy, the Fund has lowered its budget for divestments for the years through 2018 to € 75 mln. This is not a hard target for disposals and market conditions will determine when or if the Fund decides to proceed with a disposal. Any decisions to sell individual buildings or residential complexes will be driven mainly by the returns they generate.

In 2015, the Fund sold a number of individual units and one residential complex with 53 apartments, all in the regulated rental segment.

Divestments

Asset | City | No. of residential units | Rental level |

Poortwachter | ALPHEN AAN DEN RIJN | 53 | 666 |

Optimising the risk-return profile

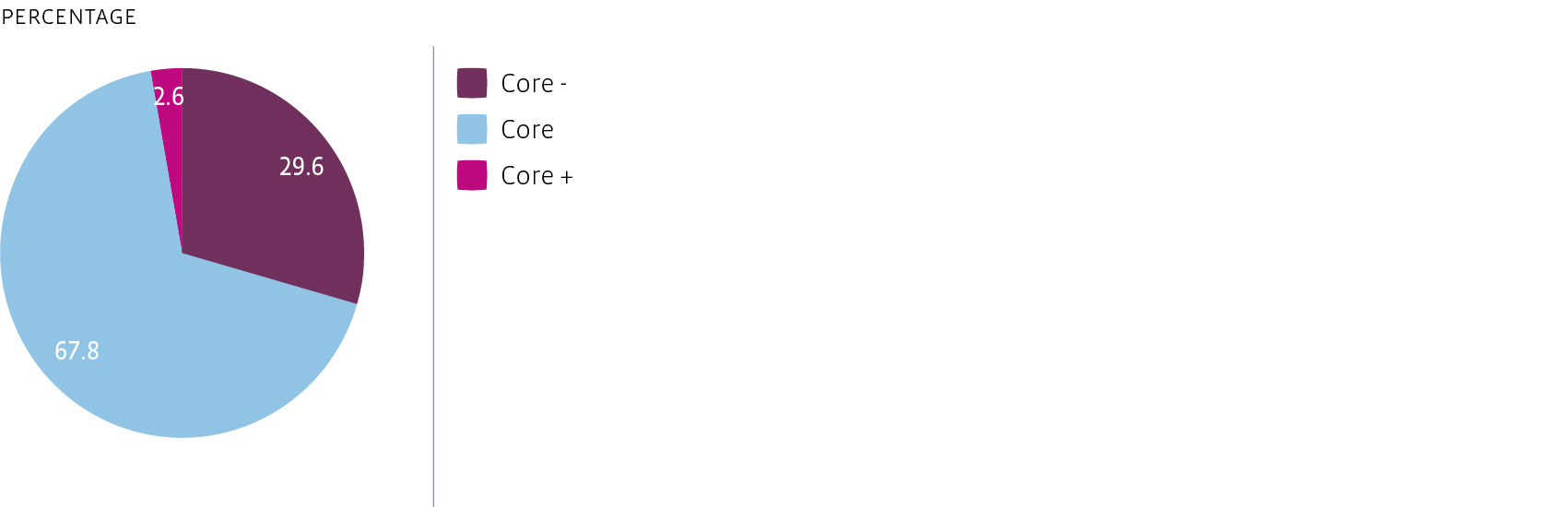

In terms of risk diversification, at least 90% of the investments must be low or medium risk. At the portfolio level, we have identified the following bandwidths to budget the risk:

50-75% lower risk

25-50% medium risk

0-10% higher risk

In 2015, active asset management of the current portfolio, acquisitions and disposals ensured further optimisation of the Fund’s risk-return profile. The Residential Fund has a well-balanced risk profile, with the focus on low-risk assets in the Fund’s core regions.

At year-end 2015, the proportion of medium-risk investments had fallen to 33.9% from 38.0% at year-end 2014, while low-risk investments increased to 65.6% from 61.5%. Nearly all of the assets acquired in 2015 were classified as low risk due to their excellent quality and location. The divested asset consisted of government-regulated homes, classified as medium to high risk. As a result, 99.5% of the investment properties were classified as low to medium risk at year-end 2015, unchanged from 2014.

Portfolio composition by risk category based on book value

Portfolio diversification

At year-end 2015, the Fund’s total portfolio consisted of a total of 216 properties containing 14,455 residential units across the Netherlands.

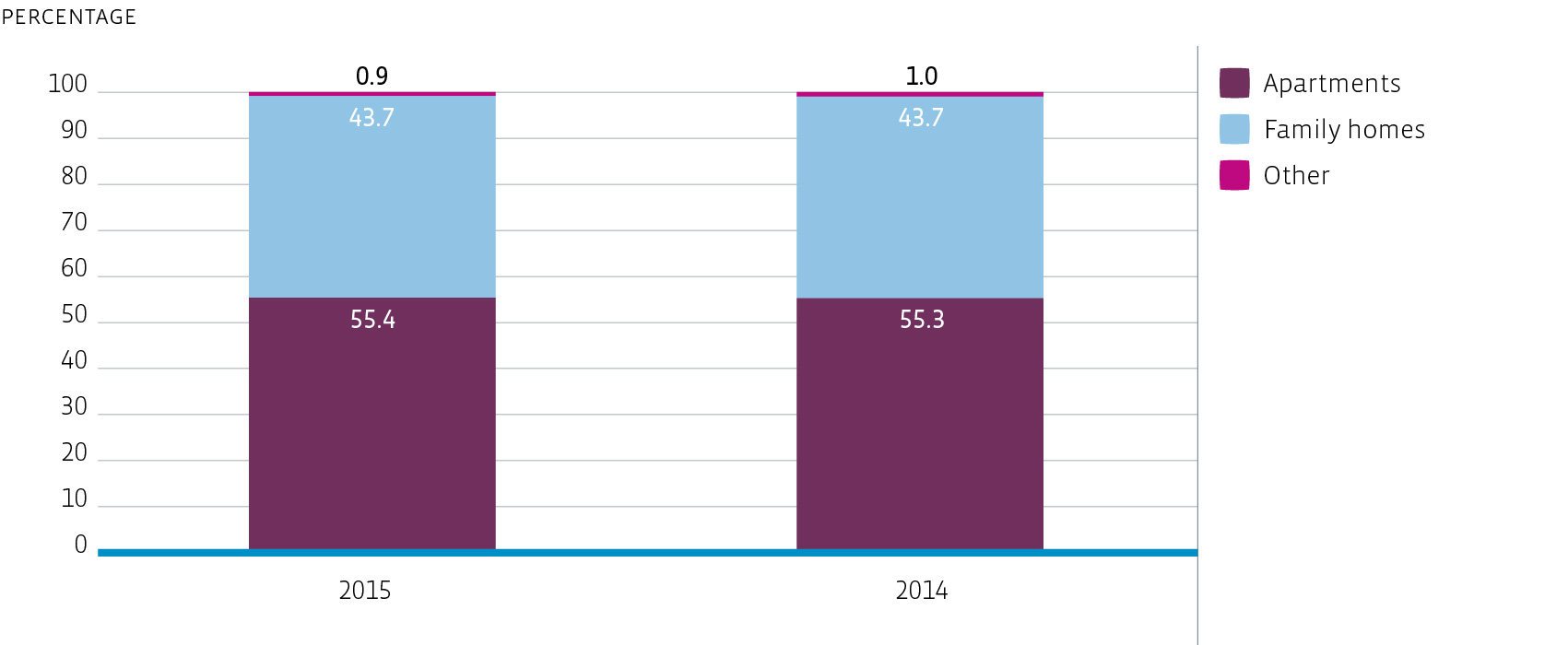

The Fund aims for a balanced mix of family homes and apartments, catering for the needs of couples, single occupiers and families alike. In 2015, the Fund bought and sold both family homes and apartments. Compared with 2014, the proportion of apartments in the total portfolio was virtually unchanged at year-end 2015 (2015: 55.4%; 2014: 55.3%).

Portfolio composition by type of property based on book value

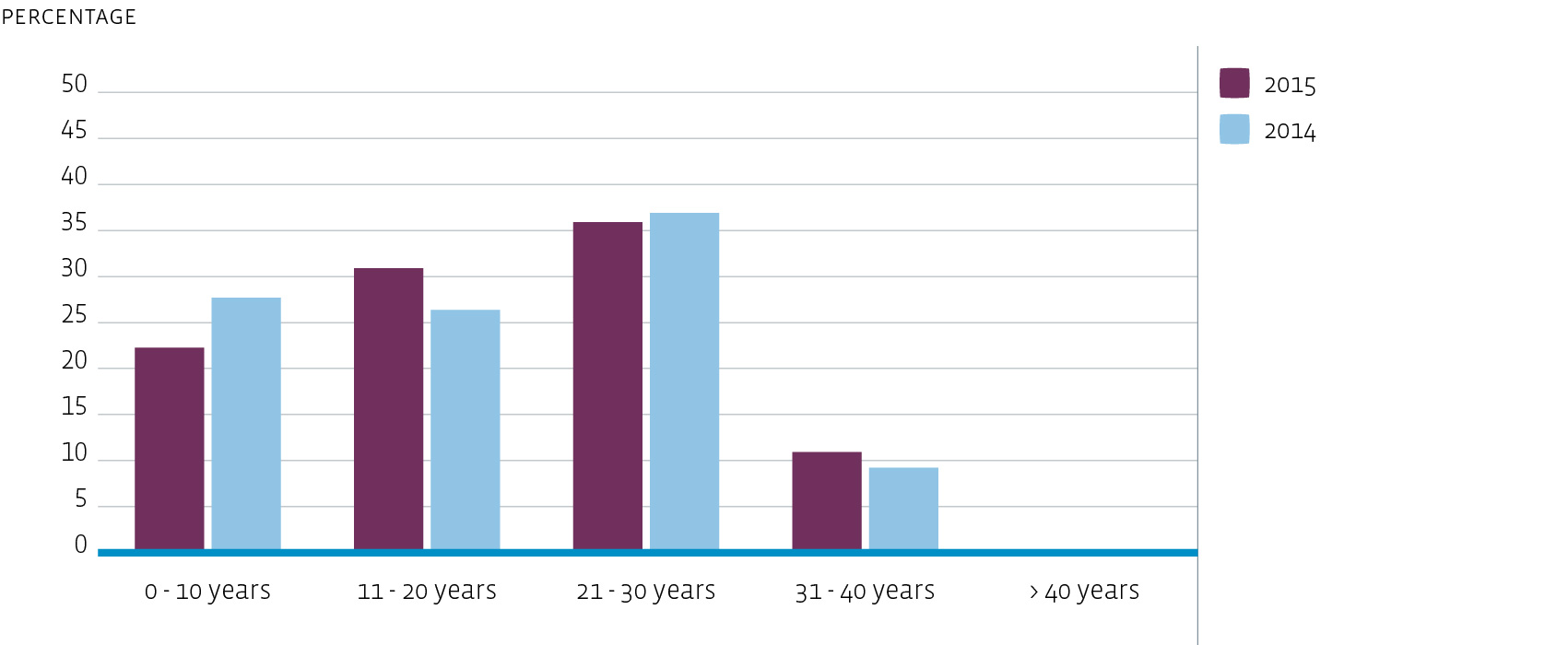

Portfolio composition by age

The Fund aims to constantly refresh the portfolio. As a result of this continuous rejuvenation, the weighted average age of the portfolio is 17.2 years (2014: 18.0 years). Despite the refreshment of our portfolio in 2015, the weighted average age of the portfolio stayed virtually the same compared to year-end 2014. As a result of the fact that we lowered our disposal target for the coming years and as a result of the ageing of the total portfolio, the weighted average age of the portfolio will increase in the future. Older assets that are held in the portfolio are kept up-to-date through refurbishments, including new bathrooms and/or kitchens.

Age composition as a percentage of book value

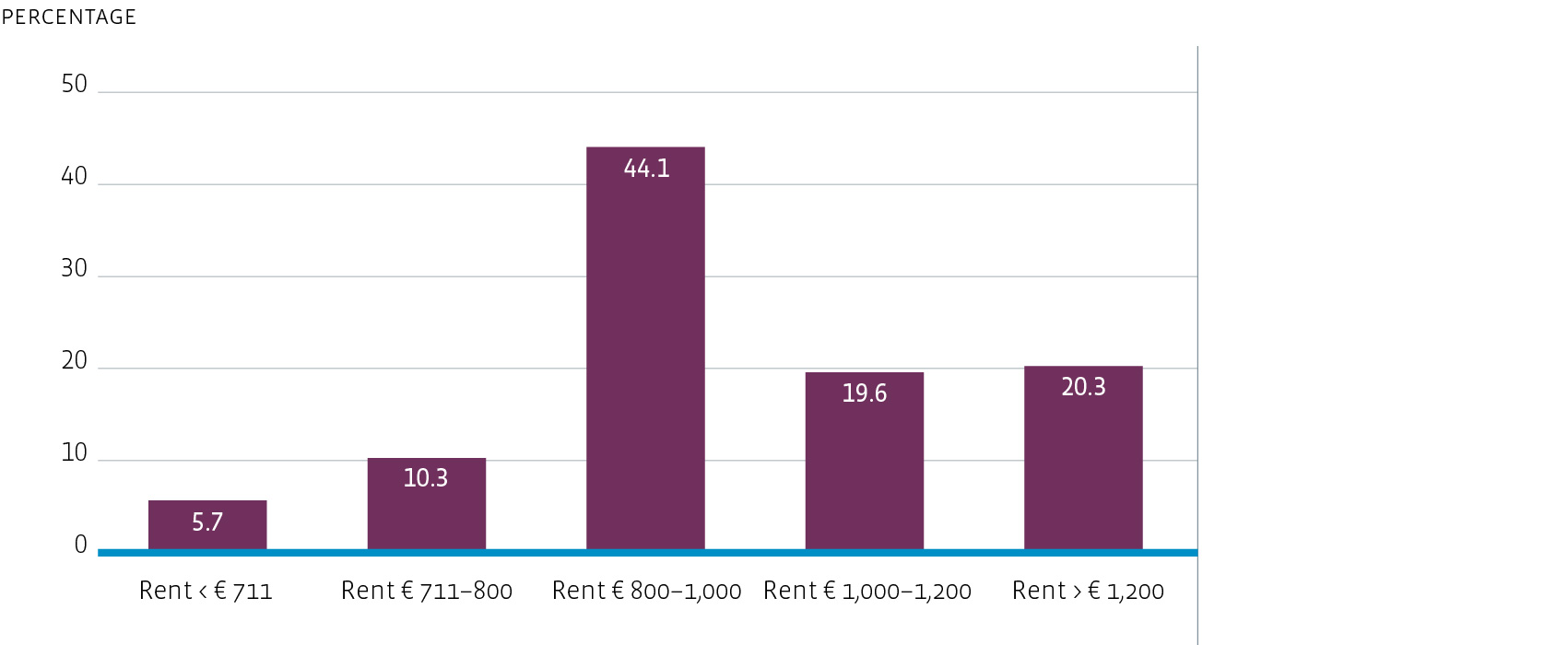

Price level diversification

With an average monthly rent of € 966, the focus of the Fund continues to be on the mid-rental segment. Approximately 75% of the portfolio has a monthly rent of between € 711 and € 1,250. With the acquisition of 2,107 homes in the lower mid-rental segment in 2015, the Fund is well represented in a segment that is in high demand due to the current economic conditions and governmental measures. Individuals, couples and families who do not qualify for government-regulated rental housing are still finding it difficult to buy due to the scarcity of financing. In addition, the rental market gives customers greater flexibility. The Residential Fund’s continuing focus on the (lower) mid-rental segment has given it a solid portfolio of prime properties perfect for this target group.

Portfolio composition by price level based on rental income

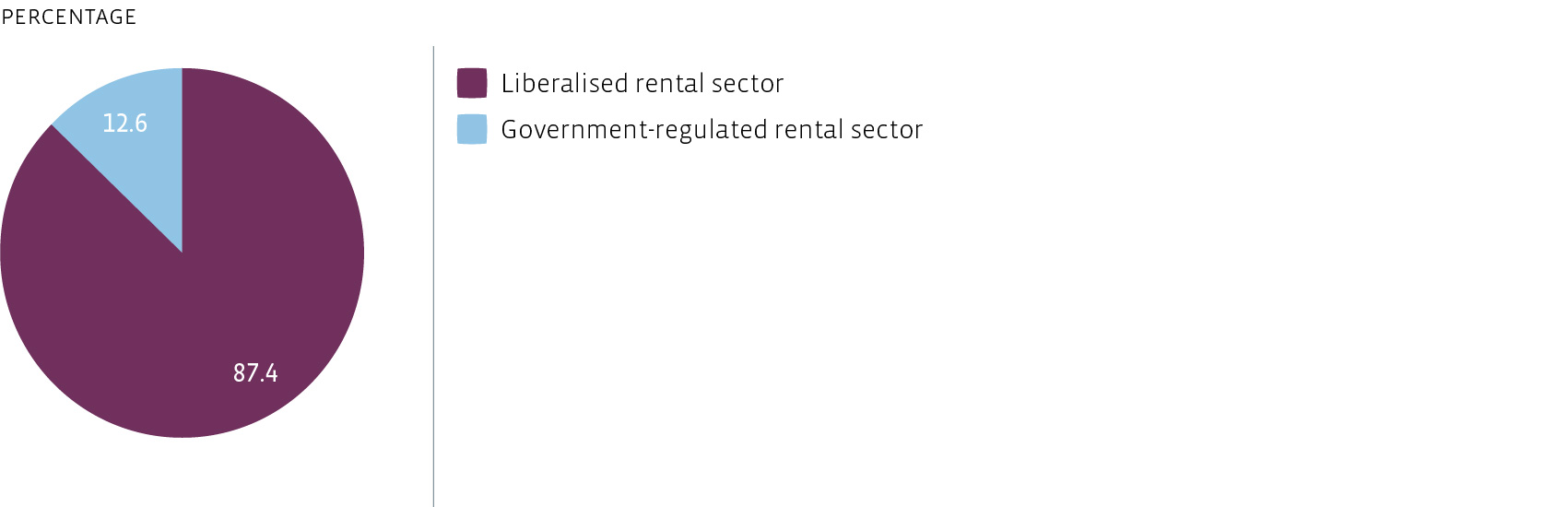

As a result of active asset management, acquisitions and divestments, we increased the percentage of liberalised rental homes in the portfolio to 87.4% in 2015 from 85.8% in 2014.

Portfolio composition by type of rent based on rental contract

Focus on core regions

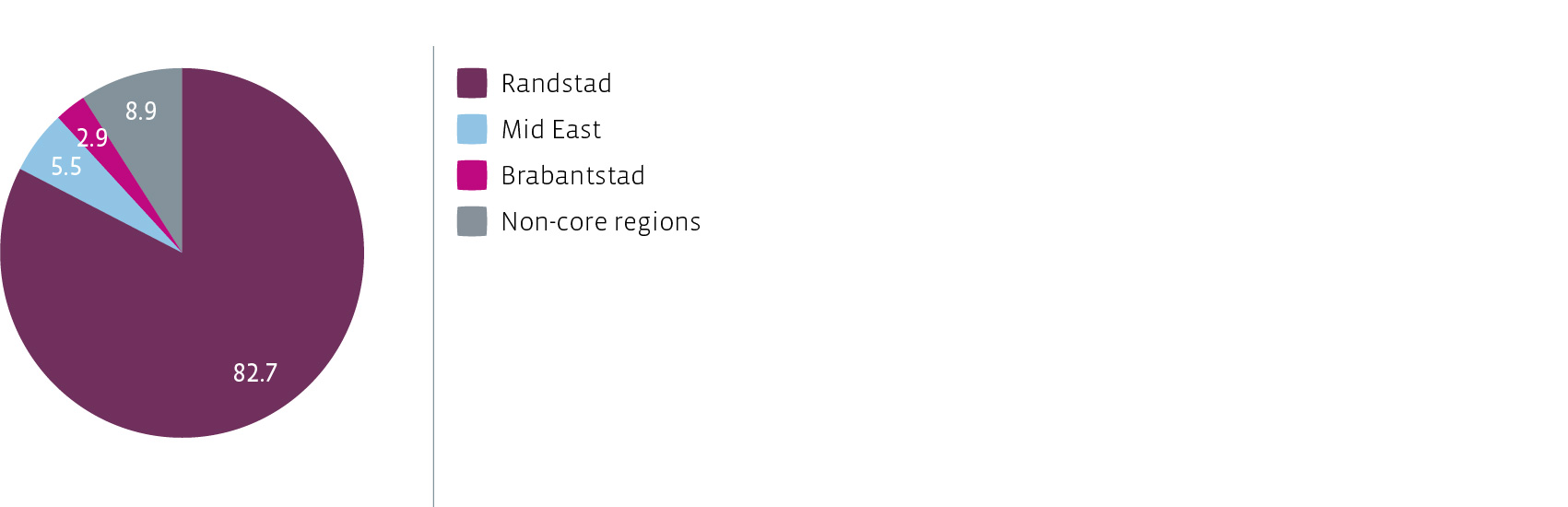

The Fund aims to achieve a balanced diversification, with a strong focus on core regions with a positive economic and demographic outlook. The target is to have at least 80% of the total value of the portfolio concentrated in residential real estate in these core regions.

Due to revaluation, together with acquisitions and divestments in 2015, over 90% of the portfolio value was located in these core regions, with by far the greatest part (82.7%) located in the core region of the Randstad urban conurbation.

Portfolio composition by core region based on book value

The Fund is constantly refining its long-term regional focus. This involves anticipating and responding to long-term trends that may affect the value of the portfolio, such as the growth of the number of households, the ageing population and steadily increasing urbanisation. The Fund’s core regions include the Randstad conurbation (Amsterdam, Rotterdam, The Hague and Utrecht), the Brabantstad conurbation (Breda, Eindhoven, Helmond, Den Bosch and Tilburg) and the eastern region (Arnhem, Apeldoorn, Nijmegen and Zwolle). These regions are expected to see the greatest population growth and largest increase in the number of households.

As the ageing of the population is a nationwide trend, it will also affect these regions. This is likely to result in increased demand for new homes for seniors. Our research has shown that the majority of the apartments in the Fund’s portfolio meet many of the requirements of the elderly, or can quite easily be adapted to their specific requirements. In the years ahead, the Fund will make these adaptations, when this is justified by the potential returns. We will also take the needs of this group into account when acquiring new-build projects.

Active asset management

Financial occupancy

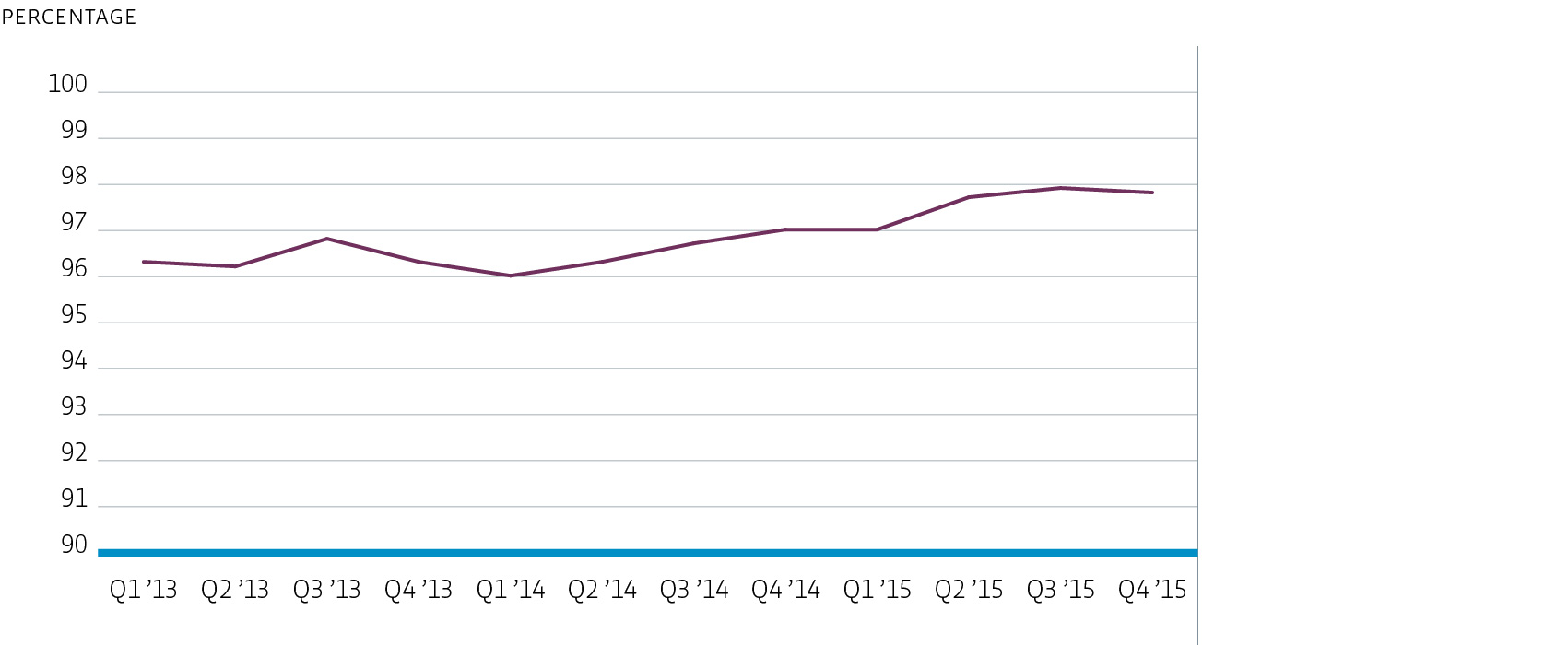

We devote a great deal of attention to preserving high occupancy levels by maintaining close relationships with tenants and property managers. Thanks to our tailor-made marketing approach, designed in close cooperation with Bouwinvest’s research and marketing departments, we know how to match our homes with prospective tenants. As a result of this approach, most new-build developments are fully rented on the delivery date.

Active asset management combined with high-quality housing products at the best locations result in continuously high occupancy rates (97.6% average in 2015; 96.5% average in 2014).

Financial occupancy rate

Tenant satisfaction

Each year we conduct a tenant satisfaction survey to gather information on the service level of our property managers and of our own financial property services department. This information gives us the opportunity to optimise tenant satisfaction. To achieve this goal, we discuss the results of the survey with our property managers individually and with our financial department. We use the result of the surveys to draw up improvement plans. These plans may be specific action plans for a single property or aimed at improving the overall satisfaction. In addition, we send our tenants a letter with information on the outcome of the survey and the specific actions the property manager and our financial service department plan to take to improve service levels. Tenant satisfaction is an integral part of the service level agreements with our property managers. The overall satisfaction score remained stable at 7.3 (2014: 7.4) and outperformed the benchmark (7.0).