Portfolio developments in 2015

In 2015, the Hotel Fund portfolio consisted of three standing assets with a value of € 142 million:

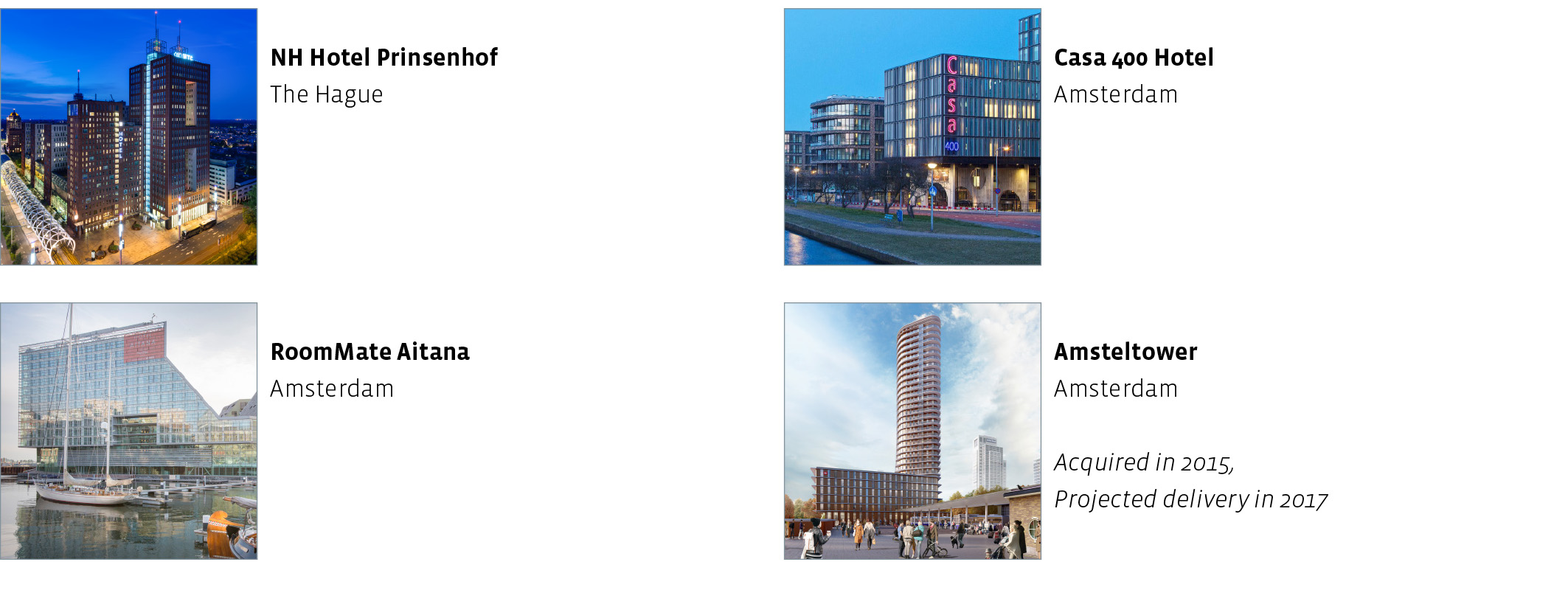

NH Hotel Prinsenhof in The Hague; 204 rooms, restaurant, bar en congress facilities

CASA 400 in Amsterdam; 520 rooms (hotel rooms and student housing), restaurant and bar, congress facilities, parking and a student lounge

Hotel RoomMate Aitana in Amsterdam; 284 rooms, restaurant and bar, congress facilities and fitness

Risk-return profile

Key factors which play an important role with regard to the risk-return profile of the portfolio are:

Asset (e.g. maintenance and age of constructions and FF&E, look and feel)

Market (e.g. market purity, competitiveness, market position, regional economic development en prognosis)

Brand (e.g. distribution mix, top/bottom-line results, volatility of profit and rental guarantees)

These indicators form the foundation of the risk-return model, which is the basis for acquisitions and annual hold/ sell analyses.

Acquisitions

The Fund examined a wide range of potential new investments in 2015, and this led to one transaction in 2015:

We signed a € 23.8 million turnkey purchase agreement for Amsteltower Hotel in Amsterdam (three-star segment, 186 rooms) with seller Provast. We have also signed a long-term lease (25 years) with a fixed rent with tenant Meininger. Completion of the hotel is expected in Q4 2017 and forward funding started in Q4 2015.

Divestments

No divestments were planned for 2015 and none were executed.

Properties