Economy and demographics

Leading economic indicators have improved

The economic outlook for the Netherlands has improved strongly in recent times. Forecasts show that the Dutch economy is set to book a healthy growth of around 2.0% per year. Employment levels are also set to rise by approximately 1% annually, while consumer confidence is higher than a year ago. Persistently low inflation is expected to boost consumer spending more than 1.5% annually. The improved economic outlook sets a solid foundation for the Dutch real estate market.

Strong demand for Dutch investments

In addition to increasing interest from Dutch investors, the amount of foreign capital from international investors has grown dramatically in recent years. In fact, the majority of real estate investments in the Netherlands now come from international investors. While real estate prices in other key markets, such as London, Paris and Munich, have already returned to or even risen above pre-crisis levels, Dutch real estate is still attractively priced. However, the continuing interest of both Dutch and international investors is quickly pushing up the prices of prime assets. This trend is expected to continue in the coming years, and investors are likely to switch their attention to secondary markets due to the shortage of prime real estate.

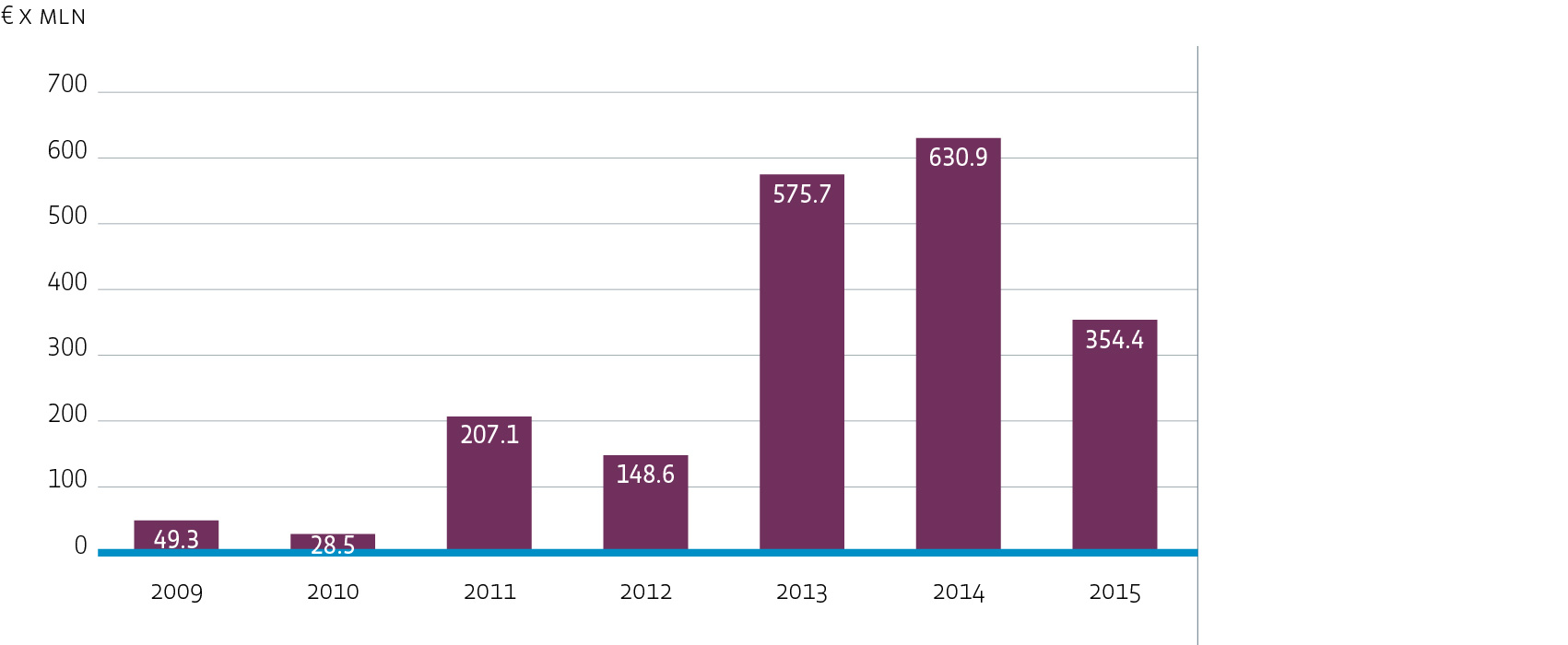

Investment volume in Dutch hotel real estate

A solid year for Dutch tourism and business travel

A record of 14 million foreign visitors arrived in the Netherlands in 2014. The hospitality industry is profiting from the expansion of the middle class and increases in tourism travel from China. Although neighbouring countries still account for the majority of foreign tourist, arrivals from China and total visitation are expected to increase in the upcoming year. Business visitation increased by 2.9% over 2014 and the number of ICCA conferences grew by five events, pushing the Netherlands from 10th to 9th position in the global ICCA ranking.

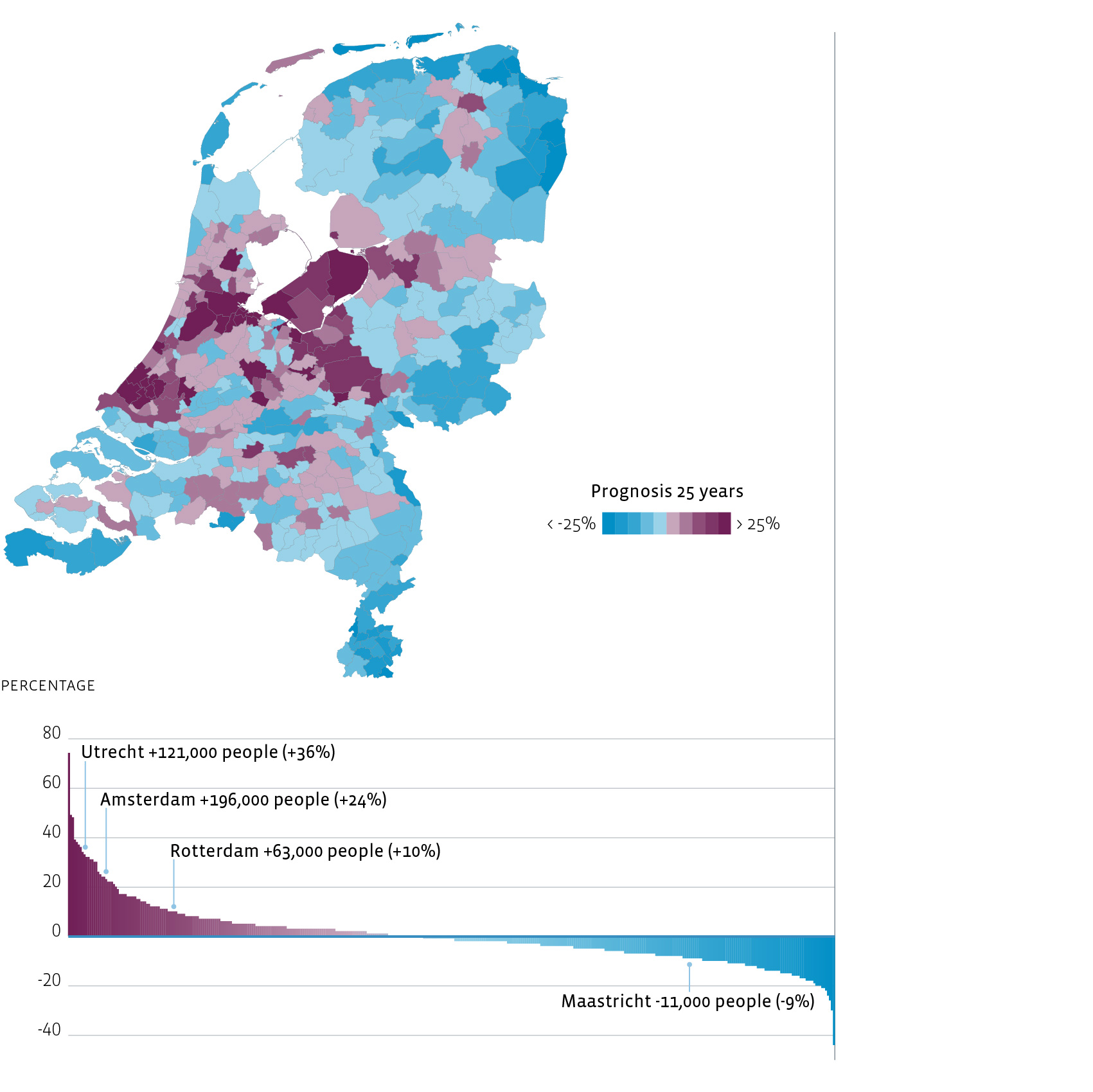

Dutch demographics

Trends and developments in the hotel market

(Figures run through end-June 2015, as full year 2015 figures are not yet available)

Strong tourism demand with limited growth of supply

The conditions within the Dutch hotel market remained solid in 2014 and the beginning of 2015. Foreign arrivals increased by 10% to approximately 14 million tourist in 2014. Recent forecasts for 2015 and 2016 show an even higher increase. In particular Amsterdam benefitted from the increase in foreign tourist arrivals and is undoubtedly the most popular tourist destination in the Netherlands.

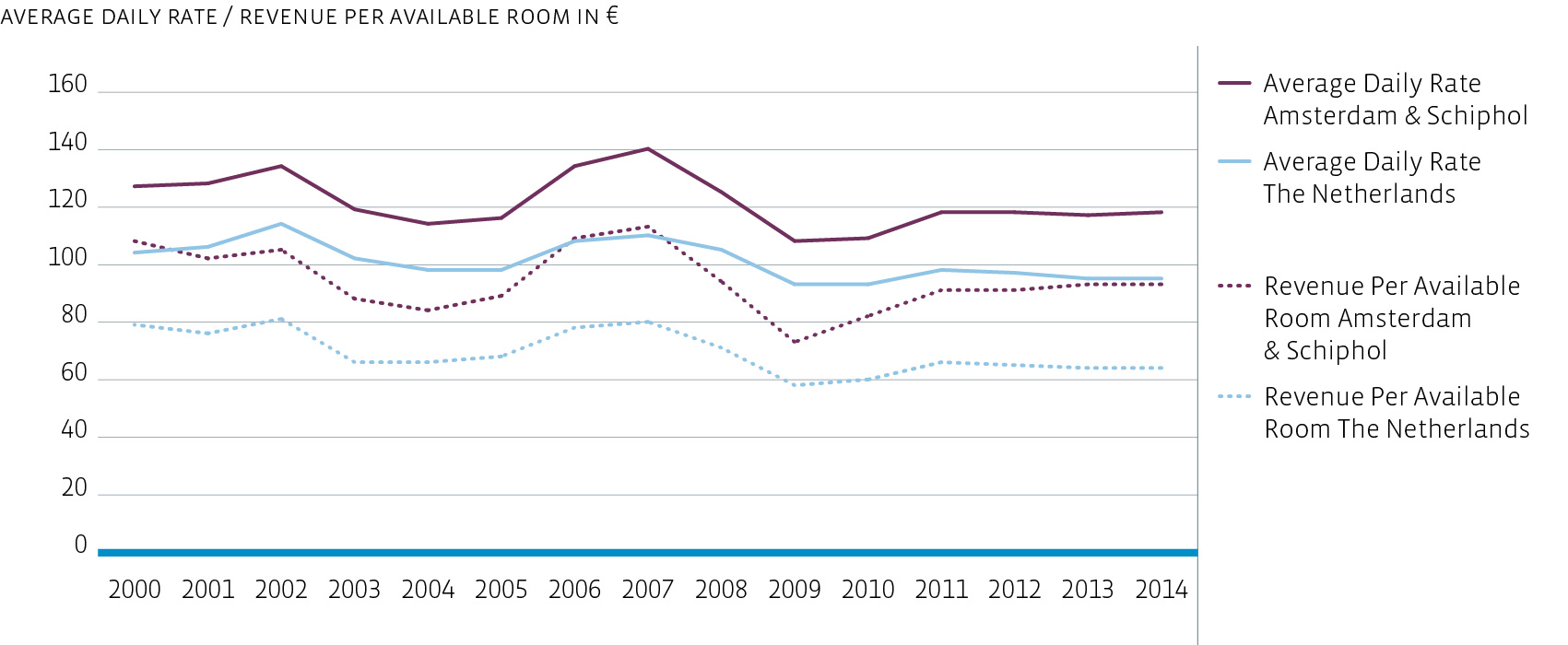

Market fundamentals on the up

According to Horwath HTL, occupancy and room rates and thus the RevPAR of Dutch hotels increased in 2015. Overall occupancy levels in the Netherlands stand at around 70% and average room rates have increased slightly to € 96 per night. In Amsterdam, occupancy rates increased by 1.4% to over 80%. With an average daily rate of € 118, Amsterdam hotel rooms stand out in comparison to the rest of the Netherlands. Despite the strong rise of Airbnb, hoteliers remain optimistic and expect occupancy rates and average room rates to rise in the next few years, as the low value of the euro helps to increase tourist figures.

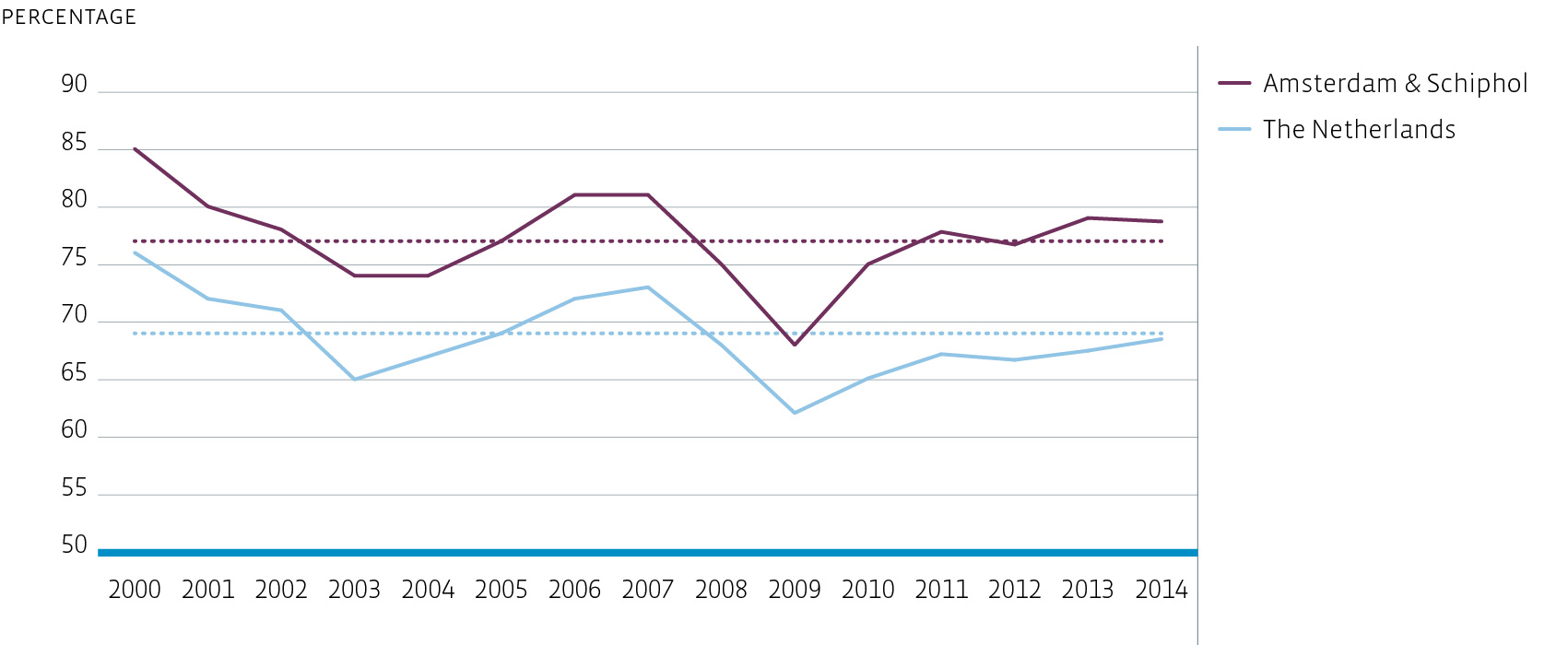

Dutch occupancy level

Investors remained focused on Amsterdam

The total invested volume amounted to € 193 million in the first half of 2015, a similar level to investments recorded in the first half of 2014. Amsterdam remains the major focus for investors, and the city accounted for more than 80% of total transactions. Across Europe, yields remained stable or increased slightly compared to the previous year. The majority of investors expect yields to harden as the battle for yields in a low interest rate environment continues. Gross yields for top-rated hotels in the centre of Amsterdam are now below 6.0%.

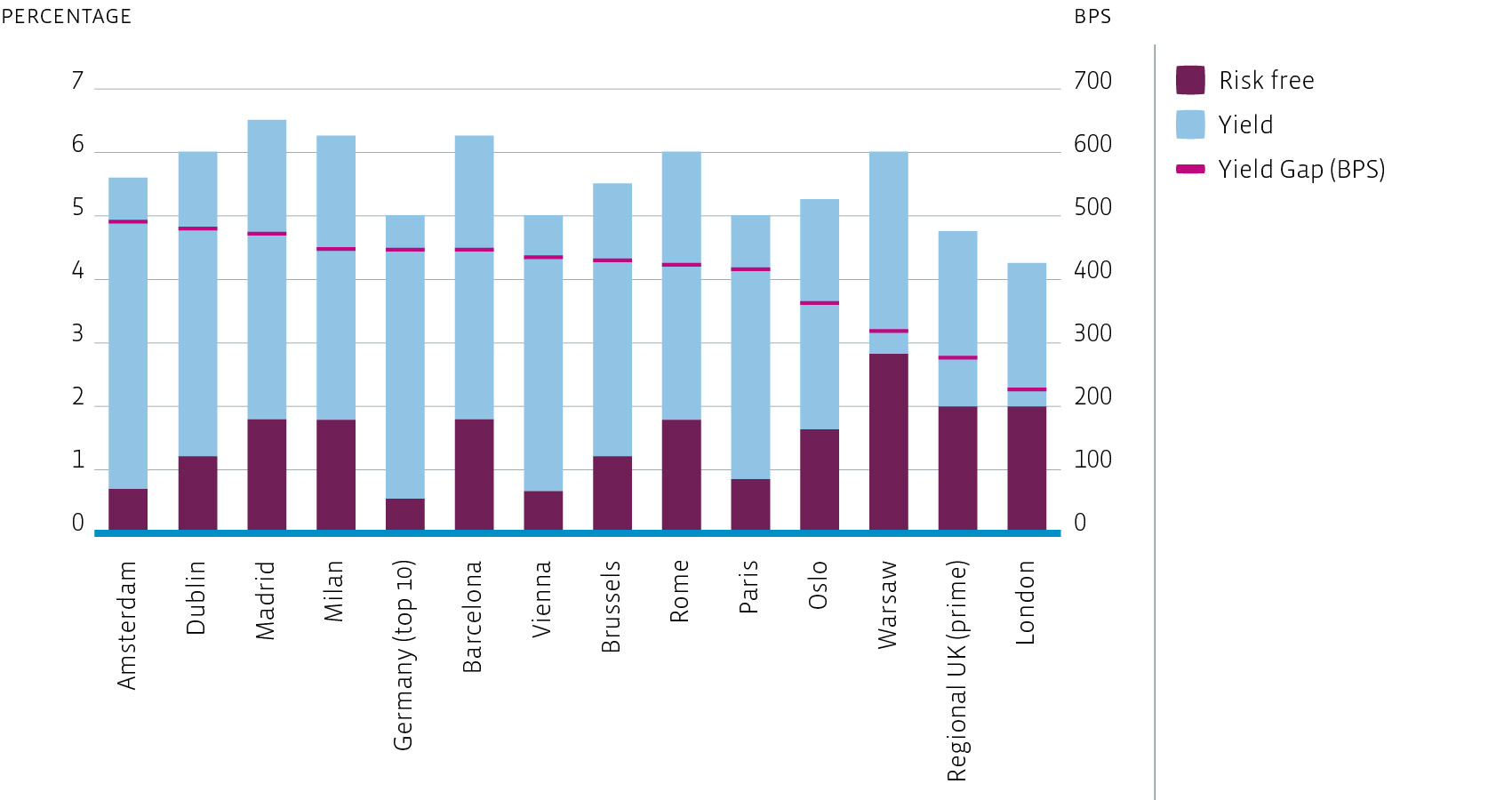

Risk free return, yields and yield gap

Growth of supply by other hotels and temporary homes

In recent years, the Dutch hotel market increased significantly in size. The Dutch hotel market with a star rating consists of approximately 2,250 hotels and more than 101,000 rooms. There is a strong drive to transform obsolete vacant offices into hotels, especially in peripheral locations. Finally, the number of homes and nights booked via Airbnb increased once again last year. However, prices and occupancy of hotels still increased slightly. The Amsterdam city council has now introduced a system of tourist taxes – similar to that paid for hotels rooms – on rooms or homes rented via Airbnb, which may put a brake on the growth seen in this sector in recent years.

Solid pace of growth in overall Amsterdam visits

New investments by the Fund are mainly focused on Amsterdam as the number one market in the Netherlands. The balanced mix of business and leisure visitors makes the Amsterdam hotel market relatively resilient. The tourist segment, which is less sensitive to economic uncertainty in the Eurozone, is expected to grow due to an increasing number of visitors from Asia and the BRIC countries in the coming years. The extension and renovation of the RAI Amsterdam conference centre and the arrival of several new conferences with more events foreseen, will further strengthen the capital city’s status as a major destination over the next few years.

AMA region to coordinate new developments

The Amsterdam Metropolitan Area (AMA) has adopted a new hotel policy that states that AMA will coordinate new hotel developments throughout the AMA region. Around 9,400 rooms are planned for Greater-Amsterdam through 2020.

Steady pressure supports growth strategy Amsterdam

Amsterdam city centre is seeing a clear increase in hotel rooms, driven in particular by the opening of new high-end hotels. A number of leading luxury hotel brands have opened recently, or are set to do so in the near future. Despite the growing supply, occupancy rates and average room rates are expected to remain stable due to the increasing demand pressure from growing visitor numbers.

Implications for hotel real estate

Four largest Dutch cities most attractive

The vast majority of hotel supply is located in the four largest Dutch cities (G4 cities): Amsterdam, The Hague, Rotterdam and Utrecht. Amsterdam in particular is regarded as a highly attractive, internationally established hotel market, capitalising on both increasing global tourism and rising corporate demand.

Airbnb affecting small tourist hotels in lower segments

As noted above, the number of homes and nights booked through Airbnb has increased significantly in recent years. The rise of Airbnb is expected to continue to affect mainly smaller tourist-focused hotels with three stars or less. Hoteliers in higher segments are more optimistic about future prospects and expect the impact of Airbnb to be less significant. Furthermore, thanks to their sophisticated booking systems and intelligent sales and marketing programmes, they will continue to secure healthy occupancy levels. Some of the large hoteliers are even exploring ways to cooperate with Airbnb.

Inner-city, well-positioned hotels will outperform

For the near term, increasing supply levels plus expected modest (domestic) demand create a challenging market. Inner-city, well-positioned hotels offering fresh and innovative concepts are set to outperform.

Combination tourists and business travellers crucial

Hotels that attract both tourists and business travellers are set to perform best. These hotels are best equipped to cope with online trends such as Airbnb, which mainly affects the tourist market.

Competitive edge for dominating chain hotels

The larger, more efficient and financially solid chain operators are able to offer a more secure long-term investor cash flow. Modern booking systems and smart sales and marketing programmes can help secure healthy occupancy levels. Smaller hotel operators generally lack the equity required to deploy such programmes.