Portfolio characteristics

16 Dutch office properties at year-end 2015 (€ 478 million, 212,995 m²)

Core region policy with a focus on prime locations in the four biggest cities

Focus on multi-tenant assets

GRESB Green Star for second successive year

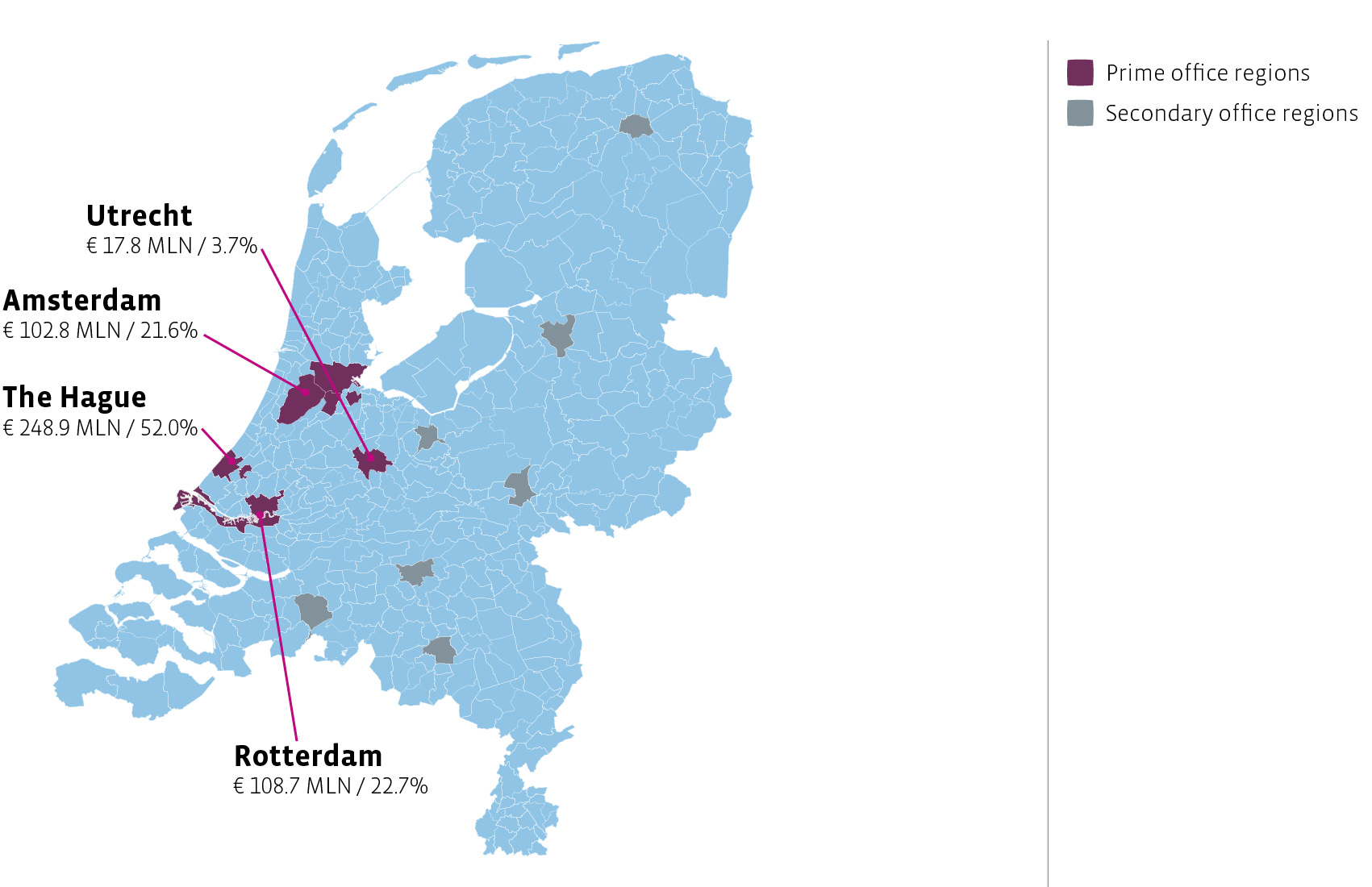

Core region policy

The Fund has four primary core regions closely correlated to the trends towards urbanisation and a knowledge-based economy. These primary core regions are Amsterdam, Rotterdam, The Hague and Utrecht. The remaining nine regions are considered secondary.

The target is to have 80% of the total portfolio value invested in properties in these core regions. This currently stands at 100%.

The Office Fund's core regions based on book value

Major segment

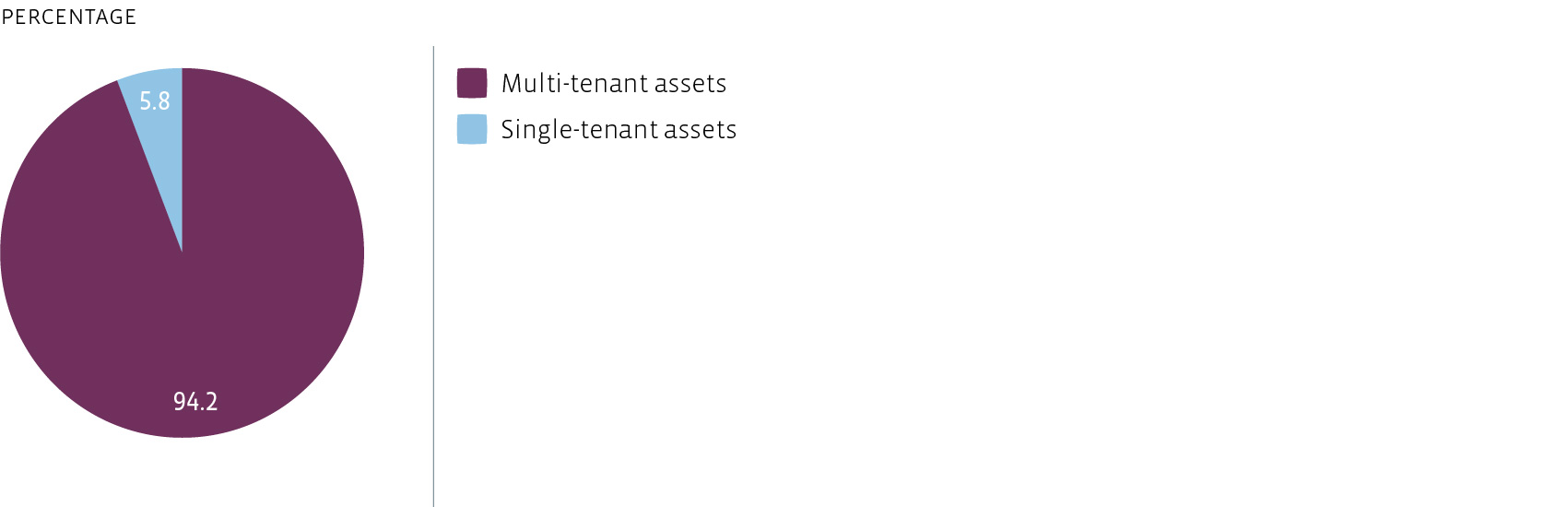

Multi-tenant assets

A diverse office population enhances a building’s image as a natural, inspiring meeting place. To reinforce the dynamic character of such work and meeting spaces, it is important to offer additional facilities in or in the immediate vicinity of the building. These can include catering establishments, child care facilities and varied networking spaces.

Users vary by sector, culture and nationality, but also in their requirements for office space. To be able to accommodate the workforce of a large corporate head office, as well as smaller satellite offices, flexibility in lay-out is a prerequisite. Active asset management also enables the Fund to respond quickly to the changing needs of its varied tenant base.

Portfolio composition by single vs multi-tenant based on book value